“We are bringing back jobs and businesses like never before. Already, more than five trillion dollars of investment and rising fast!This is an economic revolution…” President Donald John Trump regarding tariffs.

Section 4(b) of Executive Order 14257 provided that “[s]hould any trading partner retaliate against the United States in response to this action through import duties on U.S. exports or other measures, I may further modify the Harmonized Tariff Schedule of the United States to increase or expand in scope the duties imposed under this order to ensure the efficacy of this action.”

While economics was never one of my strong points or a favorite subject in university, I am giving it my best shot to give a brief overview of tariffs and the United States, with how things can be affected or improved. So, bare with me…

As I have repeatedly stated for who knows how long, the bootlicking dregs of the coastal, corporate, legacy mainstream media perpetuate the incorrect and cover ups when it came to the southern border, sanctuary cities, crime rates, a failed foreign policy and the worst administration in history, along with Biden’s cognitive bankruptcy and now there’s the question and alarms regarding tariffs. For the last few weeks, the news cycle, along with social media, has been spewing their progressive leftist, alarmist rhetoric. And let’s not forget that a tariff is essentially a tax that the Federal government charges another country to import its products into our country, which we all pay one way or the other. The countries we import from pay a price for the opportunity to sell their products and services in our country. But there is a cost to produce those products, and those countries/companies need to profit from making and selling them. And that is the progressive left’s cuss word: Capitalism.

It’s common knowledge that April 15th is accepted as “Tax Day.” However, February 3rd is the anniversary of the ratification of the 16th Amendment in 1913. It was President William Howard Taft, and its ratification, that was an effort to make sure more higher-income people paid taxes, and that the government wasn’t wholly dependent on revenue earned from tariffs and taxes on goods. The income tax was re-introduced to the country in 1913 with the passage of the Revenue Act, which established a one percent tax on income above $3000 and a top of 6% of those earning over $500,000. This act marked a significant shift in federal revenue policy, moving from the reliance on tariffs to income taxes. The Revenue Act of 1913 restored a federal income tax for the first time since 1872, the end of Reconstruction. The federal government had also adopted an income tax in the Wilson-Gorman Tariff Act, but that tax had been struck down by the US Supreme Court in the case of Pollock v. Farmers’ Loan & Trust Co.

In June 1909, Taft sent a letter to The Congress during the debate in Congress over the Payne-Aldrich tariff to lobby for the 16th Amendment. He explained that part of the Pollock decision permitted the Federal government to levy a corporate income tax as an excise tax. “The decision in the Pollock case left power in the National Government to levy an excise tax, which accomplishes the same purpose as a corporate income tax and is free from certain objections urged to the proposed income tax measure,” he said. Taxes, taxes and tariffs…pick the year, pick the century and they still present the same problem.

The Congress passed its resolution about the 16th Amendment, but the amendment wasn’t ratified until February 3, 1913 when Delaware became the 36th state to ratify it. Incoming President Woodrow Wilson pushed for the Revenue Act of 1913, which included the income tax along with changes in tariffs. Furthermore, the first 1040 tax form appeared in 1914. It was three pages long.

As the progressive Democratic left try to make a stand on their anti-tariff, anti-Trump agenda, and as I have repeatedly pointed out…they forget their historical positions and rhetoric. In 1996, Representative Nancy Pelosi(D-CA) stood on the floor of the House delivering a speech that would shock many today. She fiercely opposed granting China Most Favored Nation (MFN) Trade Status, which then Senator Joe Biden(D-DE) shoved through the Congress. Looking at 2025, doesn’t Pelosi’s pontification from 1996 parallel the arguments often made by President Donald John Trump decades later? Pelosi’s speech was filled with concerns about unfair trade practices, a massive trade deficit, and the loss of American jobs to the draconian Communist Chinese Republic(CCR). Pelosi questioned the fairness of the trade relationship, asking, “Is this reciprocal?” She pointed out the ridiculous differential between what the US was giving and what it was getting in return. Her speech highlighted a massive $34 billion trade deficit with China that had grown from $3.5 billion in 1989. The number was expected to exceed $40 billion by the end of 1996. This was far from balanced, and Pelosi’s frustration was clear. And now Pelosi, along with the Senate Minority Leader Chuckles Schumer(D-NY) are spewing a complete opposite view regarding tariffs. As for Chuckles, he trashed the tariffs during an appearance on CNN. He called them a “massive assault on American families” that will only “help the billionaires.” He’s a second rate, blowhard, windbag politician, with that comment coming from a career politician who’s watched American manufacturing collapse for decades without lifting a finger. And he’s not one to talk about billionaires considering the progressive Democrats are the party of the elite…the 1% they complain about.

The economic impact of this trade imbalance wasn’t just about numbers. Pelosi argued that America was losing jobs at a staggering rate while the draconian CCR was gaining them. She stated that the US-CCR trade relationship was supporting at least 10 million Chinese jobs but only 170,000 American jobs. According to Pelosi, this was a “job loser” for America, a claim many would recognize from Trump’s future speeches. It was a one-sided deal where the benefits flowed to the CCR.

The biggest trade deficit abuser of all the countries that put the squeeze on the US is the draconian CCR whose markets are/have weakened, having just raised its tariffs by 125%, on top of its long term ridiculously high tariffs, while failing to acknowledge President Donald John Trump’s warning for abusing countries not to retaliate. The slogs of the mainstream media are criticizing POTUSDJT’s economic plans with realizing that the main issues with the CCR is that tariffs are one third of the problem, two thirds of the problems are the non-tariff barriers which includes the dumping of products and Chinese subsidies, which generates the low cost of their exports, which are difficult to deal with. Interestingly, the Wall Street Journal and the World Bank’s stance are mirroring Trump’s tariffs in the standoff with the CCR. And let’s not forget that the CCR is deeply involved in the theft of intellectual properties and prospers immensely from our country.

After decades of the CCR infiltrating and attempting to garner chunks of the global market, President Donald John Trump’s long-overdue corrective actions, according to President Xi, is “bullying” and just a weak attempt to distract from their own economic “bullying” of the West. The CCR isn’t being bullied, but finally facing the consequences from a strong leader which they haven’t faced in four years. Beijing’s concerns are now on the verge of desperation as Australia, a loyal U.S. ally , blew the CCR off when they were requested to “join hands” against American tariffs.

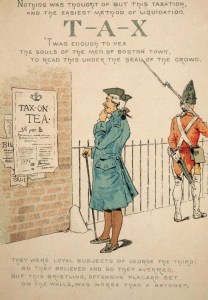

One of the central causes of The Revolution was the Crown’s stance on taxing the colonies. King George III and Lord North enacted the Tea Act, the Quartering Act and the Townsend Acts. Later on, Lord North was a leading voice in repealing the Townshend Acts, which placed taxes and duties on glass, lead, paper and tea imported to the American Colonies. After significant and substantial protests from the Colonies, at the instruction of King George, and pressure from the British East India Company, who had a monopoly on the tea trade in the Colonies, North did leave one tax in place, the one on tea that directly led to the Boston Tea Party of 1773 conducted by the Sons of Liberty. To that end, The Founding Fathers and generations of future leaders that followed them weren’t stoked on the concepts of an income tax. Tariffs and sales taxes helped fund the Federal Government in the early days.

During the course of the Civil War(1861-1865) the financial needs of the Federal Government led to the first national income tax, encouraged by President Abraham Lincoln. The Civil War income tax instituted by the Federal Government was one of several financing tools it used against the Confederacy. The government also issued bonds and used excise taxes. The Confederacy also had its own version of an income tax which wasn’t as effective. The Union’s income tax went away during the period of Reconstruction. Author John Steele Gordon wrote a brief history of the income tax in 2011 for “The Wall Street Journal,”beginning with the Civil War. Steele stated that the combination of a government surplus and a heavy tax burden on consumers “encouraged” President Grover Cleveland’s administration to pass a second income tax law in 1894.“The new tax, however, was very different from the Civil War income tax, which had exempted only the poor. The new one hit only the rich, imposing a two percent tax on incomes above $4,000. Less than 1 percent of American households in 1894 met that income threshold,” said Steele.

Interestingly, as old is new and new is old, during a 1988 interview of then real estate developer Donald Trump on “The Oprah Winfrey Show,” he criticized the current US foreign policy and trade imbalances, essentially predicting the current day global tariff landscape. His 1988 remarks on Japan, Kuwait, and allies “not paying their fair share” accurately described the current situation regarding global tariffs…as good as Nostradamus. During the course the interview, the future president added to his statement by saying “something’s going to happen over the next number of years.” After citing Japan’s trade policies that caused the US to “lose $200 million” he emphasized that it wasn’t “free trade.” Pointing out the contrast, he mentioned how the Japanese “made it impossible” for international players to enter the Japanese domestic market without having overt laws about it. And decades later, the Japanese government has not modified their import laws one bit. It’s still extremely expensive and difficult to import American products to Japan, where the government also subsidizes their domestic and imported goods.

During the course of the Oprah interview, the future POTUS added: “ if you ever go to Japan right now and try to sell something, forget about it, just forget about it. It’s almost impossible. They don’t have laws against it. They just make it impossible. They come over here…they sell their cars.. they sell their VCRs…they knock the hell out of our companies.” Additionally Trump said the Kuwaitis “live like kings“ while the US makes it possible for them to sell their oil. “In Kuwait they live like kings. The poorest person in Kuwait is living like a king and they’re not paying. We make it possible for them to sell their oil. Why aren’t they paying us 25% of what they’re making, it’s a joke.” And those comments and observations are from 37 years ago. Very astute. As it stands in 2025, Japan stated that they are open to negotiations.

As reported by Newsmax, since the implementation of the reciprocal tariffs, more than 70 countries, including South Korea, Japan and Vietnam have reached out to the White House to begin trade talks, a top economic adviser to POTUSDJT said as US officials sought to defend sweeping new tariffs that have introduced global turmoil. During an interview on ABC News’ ‘This Week,’ US National Economic Council Director Kevin Hassett denied that the tariffs were part of a strategy by President Donald John Trump to crash financial markets to pressure the US Federal Reserve to cut interest rates. The use of the reciprocal tariffs, at this point, is simply a business negotiation ploy in order to lower import tariff rates and level the playing field. And as the progressive radical left, the unhinged Democrats and RINOs, along with the bootlicking dregs of the corporate, coastal, legacy mainstream media carry on about recession, depression, shortages, etc., with an overwhelming majority of those politicians and unelected bureaucrats in all three levels of government who have never run a business, hired employees, dealt with budgets, paying taxes and working in the private sector. In other words, no business sense and no experience and no boardroom experience. President Donald John Trump has years of business experience and the expertise to conduct a boardroom.

Since the implementation of the tariffs, Israel and the aforementioned Vietnam, have knocked down their import tariff rates to zero. Israeli Prime Minister Benjamin Netanyahu met for the second time with POTUSDJT in order to discuss reducing the 17% tariff on imported products, anti-Semitism(which was never fully addressed by the failed Biden administration) and the ongoing military action in Gaza. Vietnam, which sells far more to the US than it buys in return, making it one of the largest contributors to America’s trade differential, said that it is “ready” to remove all tariffs on US goods ahead of the country’s 46% levy, set to begin April 9th. Additionally, global oil prices are down 15%, which affects more Americans and domestic businesses than the decline of Wall Street stock values. Bottom line, President Donald John Trump is basing the success or failure of his presidency on leveling the global economic playing field, which is what he promised during the 2024 presidential campaign. Long term gain is the goal. It’s an entirely different story with a politician who made promises and keeps them.

Two examples include: Taiwan’s President Lai Ching-te offered zero tariffs as the basis for talks with the US, pledging to remove trade barriers rather than imposing reciprocal measures and saying Taiwanese companies will raise their US investments. India does not plan to retaliate against Trump’s 26% tariff on imports from the Sub-Asian nation, an Indian government official said, citing ongoing talks for a deal between the countries. Prime Minister Narendra Modi’s administration has looked into a clause of Trump’s tariff order that offers a possible reprieve for trading partners who “take significant steps to remedy non-reciprocal trade arrangements,” said the official, who declined to be named as the details of the talks are confidential. The president also said other countries are “dying to make a deal” with the US while speaking to reporters on Air Force One…the art of the deal.

Italian Prime Minister Giorgia Meloni’s visit to Washington comes amid a pause in harsh tariffs against the European Union and other countries that could go into effect in June. But President Donald John Trump said the US and the EU would lock down a deal before then. “There will be a trade deal, 100%,” Trump told reporters at the White House on Thursday. “Of course there will be a trade deal, they want to make one very much, and we’re going to make a trade deal. I fully expect it, but it’ll be a fair deal.” When asked whether she viewed the U.S. as a reliable trading partner, Meloni said that she wouldn’t be visiting the White House unless that were the case. Meloni also voiced optimism about securing a trade deal with the US, and said her goal is to invite Trump to meetings on behalf of Italy and Europe to advance those talks. A tad different meeting for PM Meloni than with DementiaJoe, whom she had to repeatedly fetch. And this is the art of the deal!

Furthermore, The European Union has proposed a “zero-for-zero” tariff resolution with the Trump administration after 20% import levies were imposed by Washington. “We have offered zero-for-zero tariffs for industrial goods as we have successfully done with many other trading partners,” stated European Commission President Ursula von der Leyen. EU Trade Commissioner Maroš Šefčovič, of Slovakia, said the zero-for-zero arrangement would be applied to chemicals, pharmaceuticals, rubber, plastic machinery and cars. That would lower the price of pharmaceuticals, cars and other products that American companies export to the EU….the art of the deal!

The proposed zero tariff resolution is exactly the sort of agreement that would make POTUSDJT’s tariff pushbacks a success, with the forcing of nations to make better deals for the American workers. Yet if the agreement doesn’t line up to his specific goal, it’s at least a starting point for further negotiations. And this would be a benefit for all parties involved.

One interesting side affect reported by the New York Post, and reported by The Wall Street Journal, states that downsizing a home, in other words removing clutter, takes almost double the time it took 10 years ago, according to the National Association of Senior and Specialty Move Managers, because of all the unnecessary things Americans keep buying and tossing to the side. One estate sale detailed by the WSJ, where one homeowner had 11 hammers because it was easier to just buy a cheap new one than find the ones lost under clutter. Furthermore, aside from reducing the amount of purchases on household and electronic purchases, Americans are also becoming more hesitant to buy or lease new vehicles, and it’s necessaries, where costs have increased over the last year due to DementiaJoe’s failed economic policies, such as “Build, Back Better” and the green focused “Inflation Reduction Act,” which did nothing to reduce inflation. Car owners in the US were spending 20% of their monthly income on car-related expenses , which included auto loans, fuel, insurance and maintenance, according to a survey by the MarketWatch Guides. And don’t forget about the merchandise that is available from online retailers, which makes shopping easier.

President Donald John Trump, ever the businessman and the consummate deal maker, has a history of using misdirection to get what he wants in a deal, and the tariffs are an example of that same strategy. For example, regarding the plans for new tariffs on Mexico, he brought President Claudia Sheinbaum to the table. He got her to agree to put 10,000 Mexican troops on their side of the southern border to help assist our efforts to secure it focusing on illegal aliens crossing the border and drug trafficking, specifically fentanyl and methamphetamine. A similar strategy was employed which resulted in Prime Minister Justin Trudeau of Canada and Columbia’s President Gustavo Petro quickly capitulating to POTUSDJT’s threat of tariffs. Since the implementation of the Trump tariffs, many companies who had been doing business overseas, are bringing their manufacturing back to the US in order to reduce the profit margins that are impacted by tariffs. This includes Volkswagen, Samsung, Hyundai, LG, Stellantis and Apple. The art of the deal.

Moreover, as he was defending the president’s economic plan Commerce Secretary Howard Lutnick said that the calls from foreign officials prove that “these countries know that they’ve been ripping us off,” suggesting there was no room for negotiations…but his boss knows the art of the deal. Despite the bleak outlook from the so-called expert economists and market experts, Lutnick defended the new taxes on imports as a necessity to bring manufacturing back to the US and force trade partners to pay their due. The US’ trading partners operate with a high surplus, while we operate with a huge deficit. So, in that case the 1996 Pelosi was absolutely correct with her rhetorical reasoning to attach tariffs to imported goods and commodities. Yet, current day 2025 Pelosi, along with Democrats and assorted RINO’s, criticize President Donald John Trump’s course correction that was never addressed by previous administrations, of either party. Prices could rise, inflation percentages could rise, but in the months to come, the trade deficit will shrink, with prices and inflation expectedly falling, as industrial production returns to the United States. President Donald John Trump is reconfiguring the economic system in favor of the US, which was decades overdue, as approximately 70% of America’s trading partners are asking to renegotiate the current tariff rates…the art of the deal!

“Wall Street elites have convinced themselves that these tariffs are worse than the pandemic that stopped the entire economy,” fumes Mark Penn, though they’d impact “only a small part of the US economy, no more than about 1% of our economic activity.” Penn is a pollster and political strategist/analyst.

And let’s not forget that the economy and tariffs remain fluid, fluctuating and transitory….So, and as reported by the NY Post, President Donald John Trump announced that his “reciprocal” tariff strategy was being paused for 90 days in response to overtures from dozens of countries, but duties on Chinese imports would be heightened to 125% due to a “lack of respect” from Beijing. The announcement locks in a 10% tariff rate on most imports, including those from Mexico and Canada, which were initially exempted, Treasury Secretary Scott Bessent said, until July 8, giving the administration time to hammer out “tailor-made” deals with interested nations. To that end, US stocks rose from the operating table after POTUSDJT announced the aforementioned 90-day pause on most of his so-called “reciprocal” tariffs. In others, work with me and I work with you! The art of the deal!