From January, 2017 at the beginning of Trump 1.0, especially with the presentation of his economic policies, the so-called financial experts predicted utter failure and chaos, by opposing the Trump economic development plan, as the Democrats are perpetuating falsehoods and inflating numbers. Furthermore, at the start of both of President Donald John Trump’s (L)terms, even Nobel Prize winning economists like Paul Krugman(R), the longtime economic adviser, and staunch POTUSDJT critic, at the rag New York Times, had predicted a stock market crash and even perhaps a second Great Depression with Trump in the Oval Office. Well, guess what? There was no depression…there was no recession…the US has stronger trade agreements worldwide…industry has returned domestically and the Federal deficit has shrunk. All since Inauguration Day 2025.

As ably stated by the outstanding historian Victor David Hansen, POTUSDJT have worked with Secretary of the Interior Doug Burgum(R-ND) and Secretary of Energy Chris Wright to produce record levels of natural gas and oil. The “One, Big, Beautiful Bill,” of course, had deregulation, the continuation and expansion of tax cuts, and then the symmetrical trade he was talking about, and then the record $10 trillion to $20 trillion, probably $10 trillion, in foreign investment. Let’s not forget the economic damage DementiaJoe’s hideous policies and administration caused domestically and globally. Ridiculous spending…higher taxes…higher interest…record inflation…shortages due to the pandemic and the shutdown of the domestic oil industry. And now the radical, progressive left, Democrats and the bootlicking dregs of the legacy, corporate mainstream media are screaming about affordability. These are the people who destroyed affordability. Non-stop aggregate inflation of petrol, insurance, housing, autos, health care, food staples, with thirty percent increases under Biden. More than 6% a year, 7% a year, 8% a year on these key staple items that are so essential.

Tariffs have historically played a key role in US trade policy.Economic historian Douglas Irwin classified US tariff history into three periods: a revenue period (ca. 1790–1860), a restriction period (1861–1933) and a reciprocity period (from 1934 onwards). In the first period, from 1790 to 1860, average tariffs increased from 20 percent to 60 percent before declining again to 20 percent. From 1861 to 1933, which Irwin characterizes as the “restriction period”, the average tariffs rose to 50 percent and remained at that level for several decades. From 1934 onwards, in the “reciprocity period”, the average tariff declined substantially until it leveled off at 5 percent. Especially after 1942, the U.S. began to promote worldwide free trade. Current US tariff provisions have increased trade protectionism, which means more domestic competition, higher employment opportunities and manufacturing returning to the US.

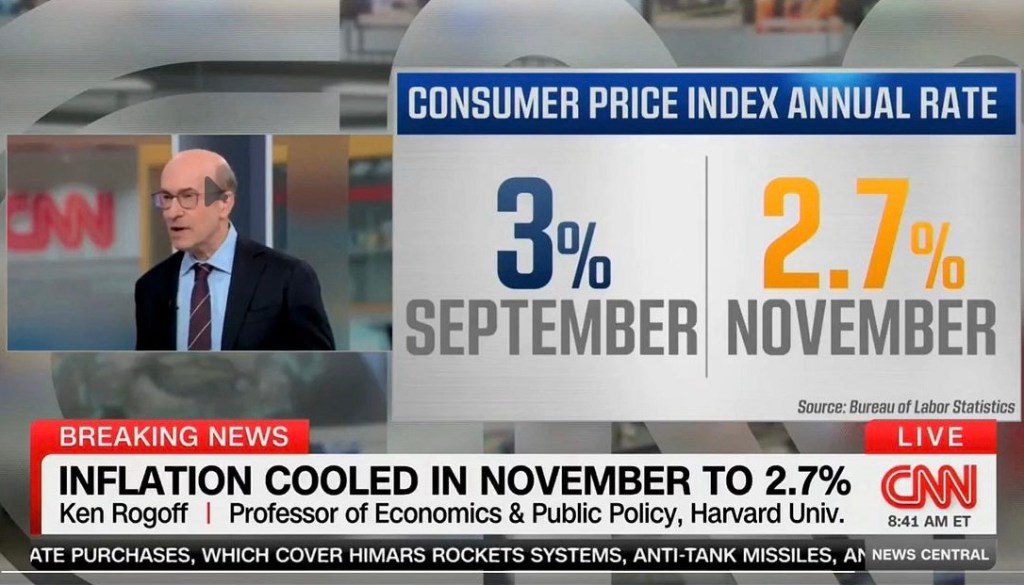

While the idea of tariffs initially were attacked by the radical, progressive left, Democrats, the bootlicking dregs of the legacy, corporate mainstream media and even anti-Trump Republicans, it is an excepted fact that Federal government and consumer spending, as well as exports, have all increased. Consumer spending, which accounts for about 70% of economic activity, rose to a 3.5% annual pace last quarter, an increase from the previous 2.5%. The Commerce Department announced the economy had grown at a surprisingly strong 4.3% annual rate in the third quarter, marking the most rapid expansion in four years. Net exports are up. The trade deficit is down. The CPI is down to 2.7%, beating expectations of 3.1%. And with interest rates and taxes coming down, the table is set for an even better 2026.

And let’s not forget that in just under 12 months, the economy is on the road to recovery after the crazy spending and record inflation numbers under DementiaJoe. Under Biden, inflation spiked to 9.3%, while the current number is 2.5%. Under Biden, the wholesale index spiked to 10.3%. The current number has been lower and will be available in January. And let’s remember that under Biden, gas was going for approximately $5.00/gallon. I am paying $2.50. Eggs were $6/dozen, now it’s two dozen for $5.00. Sure, some things are still high, but four years of economic damage cannot be totally reversed in one year. As for 2026, things are set up for America’s wallets as interest rates go down!!

The Trump administration’s emphasis on tariffs and investment, rather than consumer-driven demand, has helped power the latest strong GDP numbers while keeping inflation in check. Dick Morris, an adviser to President Donald Trump, stated during a recent interview. “What he’s done is instead of using consumer demand to hype this stuff, which can get out of hand and become a boom, instead, he’s hyped investment and tariffs and making businesses come back to the United States.”

Morris said past Federal Reserve leaders viewed it as the Fed’s job to cool the economy when growth accelerated, but he said Trump has taken a different approach by keeping conditions supportive for expansion. Further, Morris said, tariffs matter beyond revenue because they pressure companies to shift production to the US, which can boost growth without spiking demand and affecting “not just income, but the incentive for companies to come to the United States instead of relying on a consumer-demand economy.”

Moreover, oil prices have leveled off at 2% lower as investors see a potential global supply glut, and keeping one eye on a possible Ukraine peace agreement. At this point, domestic crude oil dropped $1.61 to $56.74/barrel…almost 50% less than 12 months ago…under the failed Biden administration. Under the Biden administration, I was paying almost $5.00/gallon at its height. Now I am paying $2.55/gallon and it will go lower.

Since Inauguration Day 2025, President Donald John Trump has well addressing the “Promises Made, Promises Kept” agenda. As the aforementioned radical, progressive left, Democrats, anti-Trump Republicans and the so-called financial experts, and other know-nothings of the legacy mainstream media, attempt to undermine POTUSDJT’s economic policies and achievements across the board, the country is stronger economically, stronger on the world stage, and more resilient than under the failures of DementiaJoe. Biden’s economics almost single-handedly bankrupted the country with unchecked spending and useless policies such as the “Inflation Reduction Act,” which in reality was a new green deal cover. And we haven’t even discussed the billions spent on illegal aliens. That’s for another day.

As reported by the New York Post, refund checks for the American taxpayer will be “gigantic” in the upcoming filing season because of the tax cuts included in President Donald John Trump’s “One Big Beautiful Bill Act,” as Treasury Secretary Scott Bessent predicted this week. Bessent explained that the tax provisions in the July law signed by Trump were retroactive to the beginning of the year and most workers did not adjust how much was deducted from their paychecks after the provisions went into effect, meaning they can expect a big refund when they file taxes in 2026. “I can see that we’re gonna have a gigantic refund year in the first quarter because working Americans did not change their withholdings,” said Bessent, who also serves as acting commissioner of the Internal Revenue Service (IRS). “I think households could see, depending on the number of workers, $1,000- $2,000 refunds,” the treasury secretary continued. Bessent’s estimates are on par with those from the nonprofit tax policy organization, the Tax Foundation.

The Tax Foundation reported its estimate that the OBBBA reduced individual taxes by $144 billion for 2025, adding that outside estimates suggest that up to $100 billion of that could go to higher tax refunds for Americans. While not everyone will see a massive jump in their refunds, the Tax Foundation said that the savings from the OBBBA could push average refunds up by up to $1,000.

In order to poorly demonstrate the Democratic Party’s anti-Trump stance, Governor Kathy Hochul(D-NY) and the socialist leaning Democratic New York Legislature haven’t extended the President’s “no tax on tips” policy to state income taxes, hitting bartenders and restaurant workers in the pocketbook all while preaching affordability. The “no tax on tips” policy, along with a related deduction for overtime, was a key worker-friendly provision of Trump’s “One Big Beautiful Bill” narrowly passed by Republicans this year. Treasury Department officials extended the federal tax break for nearly 70 jobs and professions, from taxi drivers to golf caddies, but the obvious beneficiaries were food and beverage service workers often dependent on tips. There are other Democratic run states that refuse to incorporate the no tax on tips into their tax cuts. Talk about hypocrisy regarding “affordability!”

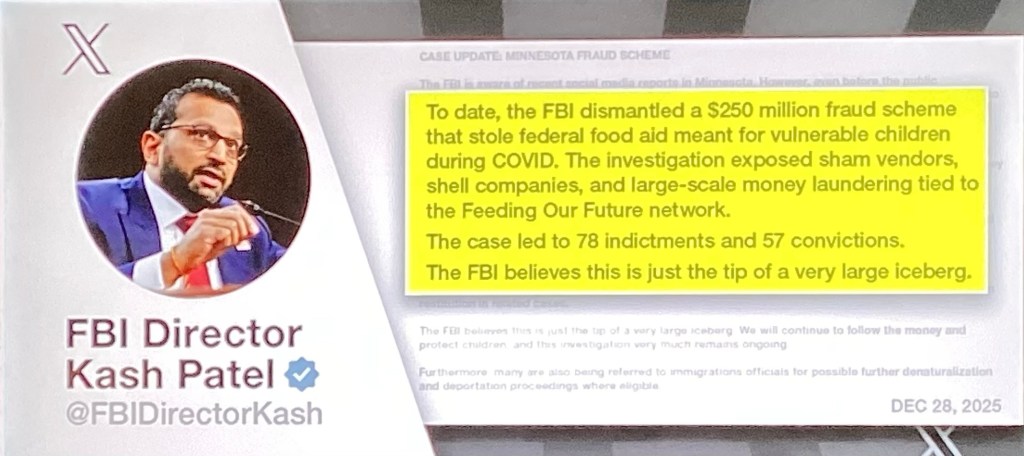

One Trump accomplishment that truly needs to be celebrated is the absolute shutdown of the southern border. Under the Biden administration, 15-20 million illegal aliens crossed into the US, which impacted the economy, crime rates spiked and financial fraud flourished. As a case in point, Arizona ranchers along the southern border say the dramatic drop in illegal crossings since President Donald John Trump returned to office has brought long-awaited relief after years of cartel activity and drug trafficking, The Arizona Telegraph reported. And the same applies to the Tex-Mex border. Furthermore, what about the $9 billion in Federal taxpayer money that was essentially stolen in Minnesota right under the noses of two buffoons…Governor Tim Walz(D) and Minnesota AG Keith Ellison(D). And just think of the utter dysfunction of the country if Kamala Harris and Walz had won in 2024…bloody scary!

And how did the anti-US, anti-Israel and anti-Semite Representative Ilhan Omar(D-MN) fatten her wallet to the tune of millions of taxpayer dollars, while billions was funneled to terrorist organizations, as her family paralleled the Bidens with dirty money? Omar went from nearly broke to being worth up to $30 million in just a year as a massive, up to $9 billion fraud scheme involving the Somali community in her district unfolded right under her nose in Minnesota. Within about a year, Omar’s net worth mysteriously shot up to $30 million, a roughly 3,500% increase relative to 2023, according to her financial disclosures. Additionally, as reported by the NY Post, Omar’s husband’s venture capital firm quietly scrubbed key officer details, including former Obama officials, as scrutiny grows over the family’s skyrocketing wealth. There are empty childcare facilities throughout Minnesota. And who brought them into Minnesota and Michigan? Obama…in order to change the voting base.

In just under one year, the US economy is off the resuscitator and breathing on its own. Yet the anti-Trump sphere refused to acknowledge or work in a bipartisan manner. And just think about the radical, progressive left, Democrats and the bootlicking, dregs of the legacy mainstream media screaming about affordability when they caused it!